Crypto Trading Bot Margin Short Sell without KYC

How to use the Crypto Trading Bot and an overview of how BitBot achieves a 90% accuracy in trades.

Crypto Trading Bot Overview and BitBot Manual

1. What is a crypto trading bot?

1.2 The Benefits of a cryptocurrency trading bot

1.3 The disadvantages of a cryptocurrency trading bot

2. Where to download a crypto trading bot?

3. Crypto trading market analysis

4. Ichimoku Analysis with crypto trading

5. MACD Analysis with crypto trading

6. Crypto trading market indicators

7. Short selling crypto’s to profit off crashes

What exactly makes BitBot Pro a cryptocurrency trading bot the easiest to use?

BitBot Pro is an automation software that connects to the cryptocurrency exchange and places buy/sell orders based on predefined criteria. This relieves investors of the need to constantly watch the markets, which allows them to focus on other aspects of their business. There are a few other crypto trading bots to use but while investing is a primary source of income for most who are looking to secure an investment portfolio. BitBot is one of the most easiest to setup crypto trading bots while others may be only set up to be used on a server or within the exchange that offers it, BitBot is ran on the client’s pc with the user’s API keys for their exchanges. With simple long or short trading settings, and the option to choose cryptos based on calculations processed by on the server side of BitBot for Pro users this makes it less guess work for anyone investing in their portfolio.

What are the benefits or disadvantages of using a crypto trading bot?

Some of the benefits when using BitBot or any cryptocurrency trading bot are automated trading allows you to easily set buy/sell orders based on your criteria. This means that you can execute trades that you would not be able to manually. If the bot uses technical analysis, you can benefit from the software’s findings without having to spend the time doing the analysis yourself, while using rumors or blogs as relevance it still does not give an accurate display of current market trends. If you are new to crypto trading, you might find it difficult to understand how the bot is programmed to make decisions and execute trade orders. There is not much need for knowing how it works more so what it looks for, eventually you can manually utilize the crypto trading signals for doing leveraged margin trades.Bots don’t have emotions and don’t get tired. They will execute your trade orders as programmed without any emotion or bias.

This means that they won’t take into account your personal risk tolerance when executing trades. Crypto Bots can execute trades at very low latency, usually even faster than human traders as binance provides fastest API access calls. It’s a good idea to start small with any crypto bot trading and test different strategies.

This will help you understand how bots can help you. If a strategy isn’t working, you can easily switch to a new one without risking a lot of money. As you set up and monitor your bots, you will start learning the best strategies to employ. You can tweak the parameters of your bots to improve their performance.

If a strategy isn’t working, you can switch to another one that might get better results. A stop loss of 2% is fair, but with some highly volatile cryptos you may want no stop loss as there is many cryptos that have a trend of pumping upwards of 15% in an hour and crashing back down as well, or some crypto that will jump 3-6% within a minute for no reason besides wash trading. It is not hard to think that someone running a crytpo exchange may have someone that is tasked with wash trading their exchange to liquidate trader’s positions and providing the volatility, there was a study recently that provided the data to prove that 70% of trading across 20-30 major crypto exchanges are all wash trades. Wash trading is basically the NFT situation you see where people are selling their pixels on a screen for hefty amounts to establish a value with that NFT, this is basically what art is and how big fish store value in assets aside from cash that can be seized or can be subject to other issues such as inflation. The inflation issue many have not understood that some actual currencies becoming worth less such as GBP not having as much buying power as the USD. While trading crypto it is going to be a good idea to take profit consistently when prices are bouncing but the fees of trading must be taken into consideration. Some exchanges fees may be higher than others.

These are the crypto bots you are looking for–and this is no Jedi mind trick and they are not mining but trading which is where all the free money is being left to be grabbed for those with the right trading algorithms which when it comes to crypto currencies like Bitcoin you may have trading bots that will either be online or client side where you downloaded it and run it from your PC.

The advantage of using a server stored crypto trading bot is that it is easier for you to manage. You don’t have to worry about being connected to the internet. You can simply run your script in the background and forget about it. You don’t have to do anything. All you have to do is install the software and start trading. But there are disadvantages to this. First, if you use a server stored crypto trading bot, you have no control over the stability of your bot. There are chances that it will become offline or it may not be performing the way you want it to perform. For example, if the software is designed to make trades, it may end up making lots of trades and lose a lot of money. Let’s slow down a bit and focus on the fact that crypto is volatile and that’s a good thing.

Why is cryptocurrency being volatile a good thing?

This makes our Crypto trading bot an anti fragile bot that is able to gain the most off of the least positions movements. It is a simple fact that cryptocurrencies are not stable and are very volatile. This means that they can experience tremendous changes in their value in a short period of time. Due to this, it is very risky to buy or sell cryptocurrencies on exchanges. Many traders who deal with this kind of currency will prefer to use a cryptocurrency trading bot instead. There are many reasons why people use them. For one, they are very easy to use and require no special skills. Secondly, they are very cost effective. The amount of money you have to pay to use a cryptocurrency trading bot is much less than the fees you would have to pay if you were buying and selling cryptos on a platform.

Now you may be thinking of arbitrage but we aren’t taking crypto from one exchange and offloading it on a different one, this is a myth more so a scam that is perpetuated by spammers trying to get you into their pump signals group and then have you use their special exchange that is designed to steal money from you.

Crypto trading bots are designed to execute trades automatically and provide you with the information you need to trade effectively. A number of crypto trading bots have been developed and they are available on online marketplaces like Quandl, CryptoCurrency Mining. In contrast to other crypto robots, which are stored in a central database, servers stored trading bots are designed to execute trades when they are accessed. However, this means that these bots are vulnerable to downtime or issues with the API connection to the preference of exchanges.

If you want to know how to make the most of the Crypto trading bot, you have to know how it works. There are various types of bots.

What is a crypto trading bot useful for if many are using it?

While they are probably ran by crypto users who have more than they need it seems to be a very big social experiment or psychology study to see what happens when you pray on the unwitting and take advantage of their kindness. Now when we think of hacking or reverse engineering there is no reason to always be thinking of it negatively as we can and have already done plenty of good exposing these scams or virus.

Can i earn a real passive source of revenue with crypto trading AI?

This is where we’re adamant that we can provide the common user to automate their income and be able to make not only a surviving wage but an actual meaningful income to support more than just yourself.

How does a crypto trading bot work?

1. How does a crypto trading bot work? Crypto trading bots are computer programs that trade on the crypto markets. They use algorithms and other programs to make trading decisions for the user.

2. Why would I want to use a crypto trading bot? Using a crypto trading bot will allow you to trade in the crypto markets without having to pay high fees. There are many ways to use a crypto trading bot, such as setting a stop loss, limit, or trailing stop loss.

3. What is a stop loss? Stop losses are used to protect your account from losing too much money. You can set a stop loss for a certain percentage of your account or a specific amount.

4. What is a limit order? Limit orders are used to buy or sell a specific amount of an asset. You can place a limit order at a specific price or a range of prices.

5. What is a trailing stop loss? Trailing stop losses are used to protect your account from losing more than a specified amount. A trailing stop loss will automatically sell your position when it reaches a certain price.

6. How do I start using a crypto trading bot? To start using a crypto trading bot, you need to download the software. Once you have the software, you’ll need to register with the bot provider.

7. Can I use a crypto trading bot on my mobile phone? Yes, you can use a crypto trading bot on your mobile phone. The best way to use a crypto trading bot on your mobile phone is to use an app. You can find apps on both Google Play and Apple’s App Store.

8. What does a crypto trading bot do for me? A crypto trading bot will allow you to trade on the crypto markets without having to pay high fees. There are many ways to use a crypto trading bot, such as setting a stop loss, limit, or trailing stop loss.

I’d think you’d find out if you’re able to reverse how some crypto bots work you’d see that most server based ones are the least effective. You’ll find it more convenient to use a client side hosted crypto trading bot and the exchange to connect it to with the API keys which means you allow the crypto trading bot access to exactly what you want it to access.

The API access for a crypto trading bot like BitBot Pro is easy to setup

This means no withdrawing to external wallets. So you can imagine how many times i hear people assuming something is too good to be true and ask what is stopping this crypto trading software from lifting my whole crypto portfolio? And that’s where we come into save the day. You don’t need a plan B as it will just distract from plan A.

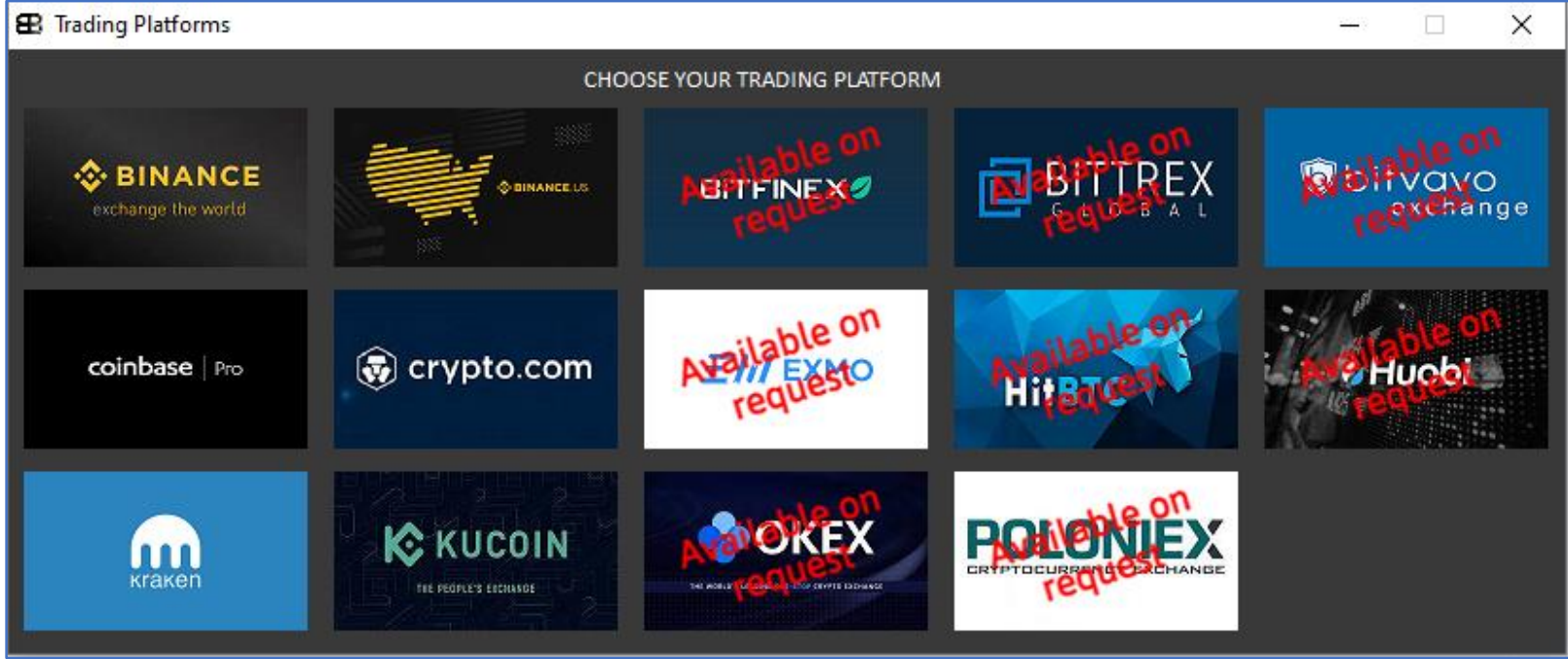

What exchange is recommended with the BitBot Pro Crypto Trading bot?

So with the bitbot pro being prime and ready for quite a few various trading types it seems they’ve gotten it in good with the Kucoin exchange as most of their features such as short selling and leverage are on kucoin very accessible and while simple to use you will see that there is still a limited amount of cryptos to short sell (about 200) with margin in comparison to spot trading which has easily over 777 cryptos and so the endless opportunities in turning a profit are non stop. I’ve seen many pumps and dumps but none like some of the available cryptos available in kucoin are so volatile you’ll see a 13% pump and dump within under an hour.

How long does it take to get super yacht with crypto trading automation

If you’re able to catch that trade with a leveraged position you will find yourself trading with a significant gain and sooner to be in that super yacht.

Just don’t get it seized by speaking Russian as you may be one спасибо away from being sanctioned. So keep in mind that if you are using 10x leverage which is accessible without having a KYC account so you can be sure that your privacy in trading is secure and you also don’t need the benefits of KYC.

Crypto trading bot that has margin leverage auto borrowing like BitBot Pro

on kucoin the default is 5x in cross margin and 10x in isolated margin trading pairs which means you won’t be able to go from shorting dogecoin to using the collateral gotten gains to pump up some alt coins that have wild gains such as 30-333% gains in a day so you’re basically multiplying your gain and to simplify how easy it can be to trade your way from $100 starting balance and using 10x isolated margin to get a 1-3% gain daily with 10x is basically a 3% would then be a 30% gain and then you could easily reinvest your daily earnings from a 30% profit margin that is of course from our 10x 3% gain and those little moves with a leveraged auto borrowing set you will find this the most lucrative turn around for your crypto trading as just having $10,000 is enough to move bitcoin by $100 With using $10,000 in isolated margin 10x would let you trade with $100,000 so a 1% gain is an easy $1000 profit to stack onto your $10k collateral and finding yourself a new day trading crypto bot.

Where to download the free crypto trading bot to try out on any exchange

Getting started with BitBot Pro is easy just to sign up and get a 3 day key to try it out on your preferred exchange. You can get the regular BitBot or BitBot Pro for 3 days and if you do not like it just request a cancellation before the 3 days are up. While BitBot is designed for established crypto balance holders who want their crypto portfolio on their exchange to be consistently sold off on before expected crashes and buying back after a stabilized dip. This is a long trading method, so while it is a good long term strategy for those with a big balance that they want to grow steadily there are newcomers who want to put $100 or even $1000+ to get fast results.

This is where short selling comes in handy and if you had notices many exchanges do not allow short selling cryptos but KuCoin is one that allows short selling without KYC info submitted. So after buying you would setup your KuCoin account and get your API info and deposit crypto from your preferred exchange to buy bitcoin or tether, as we will primarily be discussing how to trade with USDT trading pairs. You will find cheap fees buying crypto from coinpayments.net, mercuryo.io, cashapp, kraken, and i would suggest not buying crypto on coinbase unless you’re planned to get it stuck in their holding period that lasts a week before you can transact it.

This will probably more than likely result in loosing a substantial amount of your balance if you use coinbase and are not able to transact it. Another similar issue with Binance is their 5 day holding period when you deposit fiat, apps such as cashapp allow you to buy and send bitcoin same day if you’re approved to withdraw crypto externally. And for accounting reasons you will be glad you have your KuCoin account setup without KYC as you do not need the extra leverage/margin options above 10x provides risk that is not usually worth the reward as you may make a 100x trade and it will only take 1% negative on the trade to be liquidated, so being able to use 10x with $1000 provides $10,000 to trade with on isolated margin without KYC which is very convenient.

Also Cross margin provides 5x borrowing so you can trade short and long simultaneously with the same balance, if you wanted to short sell a crypto with 5x so you are using $1000 and borrow 5x so you short a position for $5000 and then have the tether ready to be used for a long trade providing you an easy way to use margin if you are shorting an crypto asset that is consistently dropping in value such as bitcoin or doge, being another great option to short sell to provide liquidity to trade long with. So those who are new to trading and want to make a daily profit an establish their portfolio, while starting with $100 if you were to gain 30% daily you would a billionaire in a year if you kept reinvesting that profit. So combining $100 with 10x margin would give you $1000 to trade with therefore making a 3% trade with the $1000 would make that a 30% gain for the $100 collateral that was started with, resulting in a balance resulting with $130 after that 3% trade.

Many people may react based on rumors or news of the cryptocurrency market which is driven by supply and demand, there is many people who are concerned about tether minting billions at a time for their exchanges they have deals with. To understand how supply and demand impacts the value of a cryptocurrency, you have to understand how traders use technical analysis.

Crypto trading Bots such as BitBot able to trade simultaneously the exchange and position of short versus long

With bitbot pro you get many benefits such as short selling, the primary source of all future expected profits to be made. Being able to be programmed to execute specific strategies based on your personal preferences, such as risk and profit tolerance, or the amount of time you have to monitor trades as well as being able to run multiple sessions to monitor multiple exchanges for trading opportunities, which means you don’t have to monitor them manually. If you do plan to manually monitor them, Bitbot provides the tools needed to secure winning trades allowing you to manually put in leveraged margin trade positions. There are many ways to Use crypto trading bots effectively, BitBot Pro makes it just a bit easier.

Crypto Trading Bots are very hard to come by and rarely do they ever make sense to use or how to use. This crypto trading bot with BitBot Pro makes it easy Ninja profits all while being on autopilot and has been steadily making it’s user base profits daily and sometimes with utilization of the graphs manually it helps take out the guess work right away you can distinguish what is ready to be trading long or short as well, it can do short selling and long trading so you can profit on both inverses of the market. Whether it’s going up or down, the BitBot will know exactly which crypto to cash in on and cash out of. Managing your portfolio on your crytpo exchange has never been easier, it is no wonder some exchanges offer bot solutions but they are sometimes a bit confusing to setup and lack the results you are expecting from automated crypto trading.

How a crypto trading bot achieves 90%+ accuracy trades

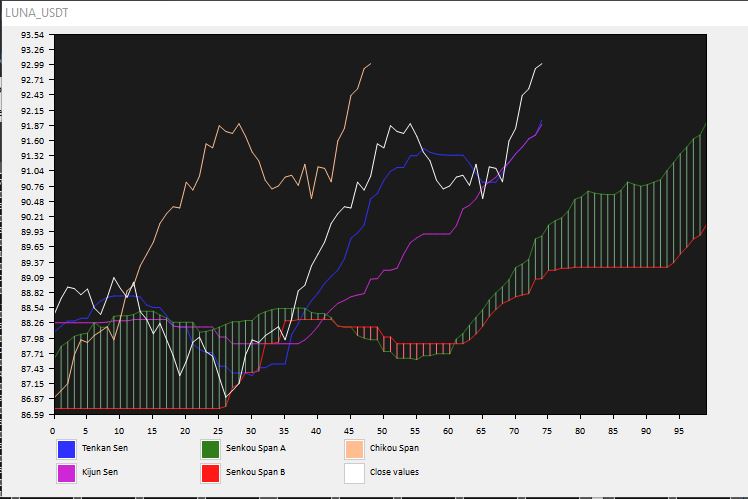

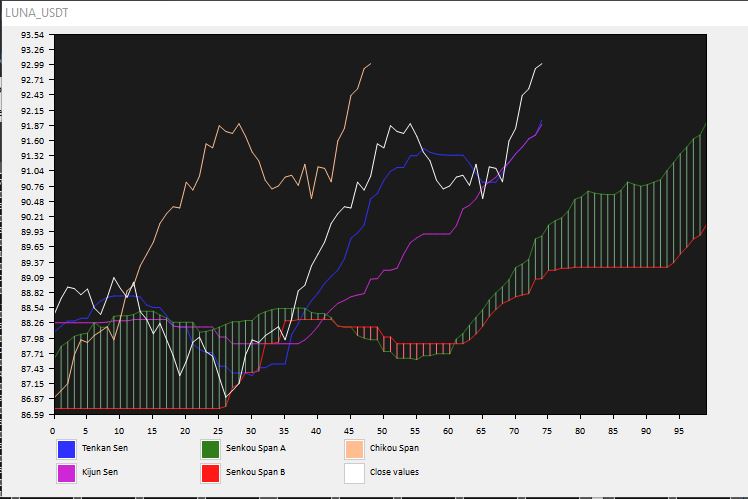

BitBot Pro will significantly increase your profits by executing multiple trades simultaneously. takes Ichimoku analysis and MACD analysis both into factor along with histogram market indicators. All while being able to utilize all of these market indicators and calculate current market trends with server side checks. While BitBot is ran on client side so you have a more accurate way of trading, you can use the Pro version that opens the ability for short selling trades and also server side calculations. For many people, the crypto market is just too volatile and risky. While volatility and risk increase our profits as we utilize short selling. Many investors have lost money, and many of those are now too scared to invest in crypto. However, crypto trading bots have been around for a few years now, and they can be a good way for investors to reduce risk and exposure to volatility, while still making a profit.

Display of the Ichimoku Analysis on the BitBot Crypto Trading Bot, it is quite easy to understand this graph. With the forecast being where the Kijun Sen, Tenkan Sen, Chikou Span & Close values are converging at we can clearly see what is going to happen with the crypto if it’s going up or down, this crypto trading bot factors this in with MACD analysis as well.

This is the type of crypto trading bot you’ll need to maintain your crypto portfolio, there is no reason to get eaten by the whales who already know the waves of the crypto ocean and how to make money off the various market variables. It all comes down to numbers with the crypto trading bot we have been using is very good at what it does currently with storing our API keys client side as well, we don’t have to worry about any server storing them and being vulnerable to mismanaging our api keys. So funds are always safe with this bot, the best part you can try it out for free for 3 days with no questions asked refund. The documentation is very easy to understand so you can tell there was quite a good amount of effort into conveying the simplicity without leaving detail.

It’s using verified math that is also known as Ichimoku formula which has been around for awhile in many different markets to forecast accurately where the cryptos you’re monitoring are going to keep pumping or crash so you can open positions accordingly. Lately it’s been quite the cash cow to be short selling in crypto, something is usually always crashing. This bot will make sure to keep your shirt and make you profits every day, now wait until it has the ability to use 10x isolated margin trading, so your 3% daily gains will turn into 30% daily gains.

In conclusion, ichimoku is a Japanese technical indicator that is used to predict price movements by analyzing the relative strength of the price movement over the past few days. It uses the relative strength index (RSI) to determine whether the market is moving up or down. RSI is calculated from the closing prices of the last period. The higher the RSI number, the stronger the recent price action. If the RSI is above 70, it means that the market is in an uptrend. If the RSI is below 30, it means that the market is in a downtrend. Ichimoku is a great tool to help you identify potential turning points in the market. It can be used as a tool to identify support and resistance levels. Ichimoku can also be used to identify when to take short and long positions.